100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.Please appreciate that there may be other options available to you than the products, providers or services covered by our service. compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. We may also receive compensation if you click on certain links posted on our site. We may receive compensation from our partners for placement of their products or services.

While we are independent, the offers that appear on this site are from companies from which receives compensation.

Turbotax review before file for free#

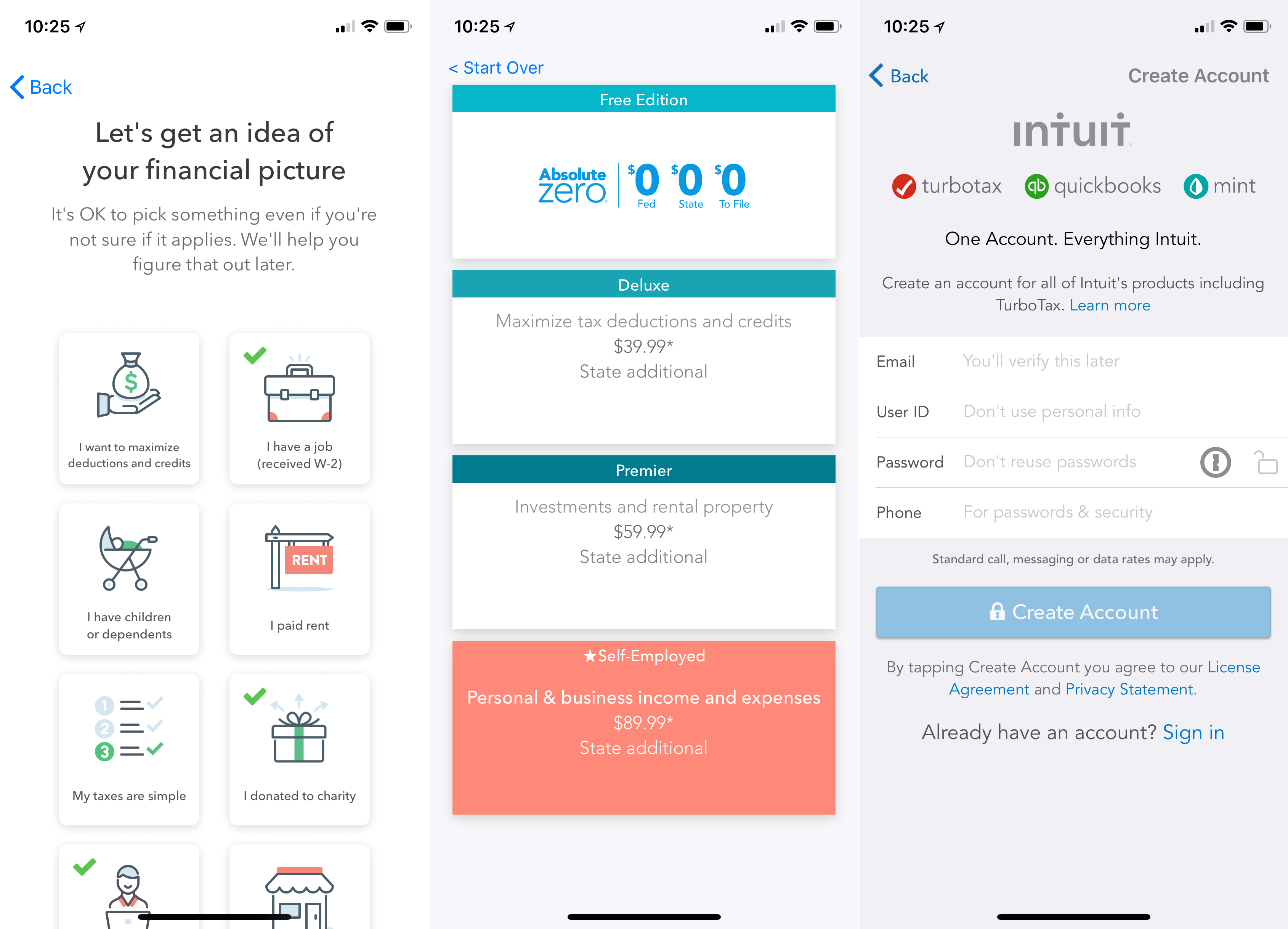

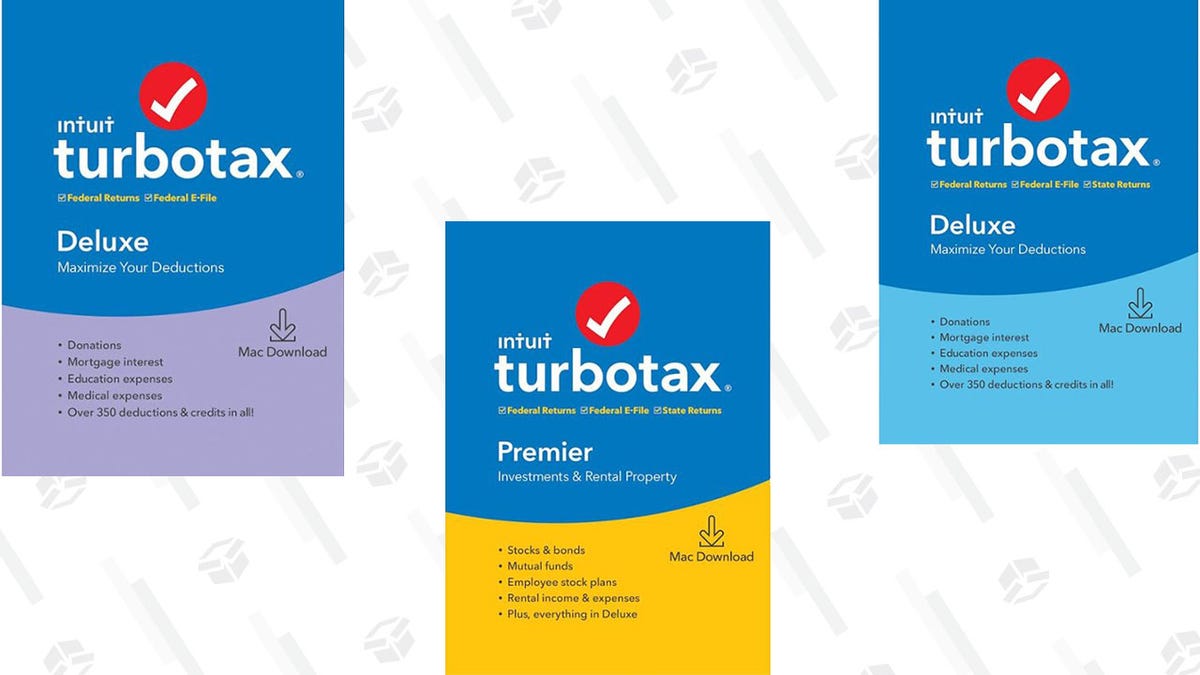

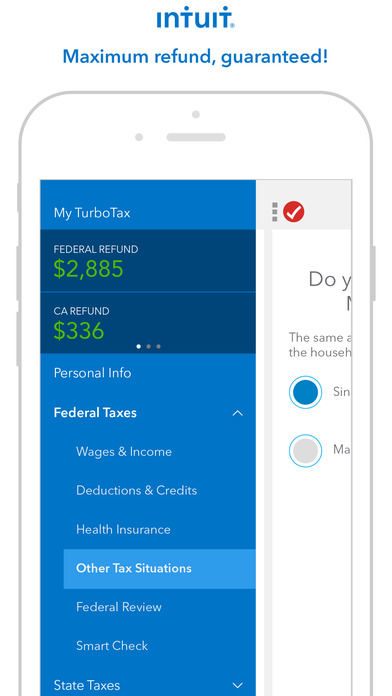

Yes, you might be able to file your taxes for free with Intuit TurboTax if you have a simple tax return Form 1040 without schedules 1, 2 or 3.į is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. However, thirty-party fees may apply if you use an out-of-network ATM.ĭoes TurboTax offer free tax preparation services? You will also have access to an ATM network without withdrawal fees. There are no monthly, overdraft, minimum balance or inactivity fees. Our answers to more questions asked about Intuit TurboTax.ĭoes it cost anything to use the Credit Karma Visa Debit Card? You can also browse alternatives to tax refund loans to find more ways to get the funds you need. Miss the deadline to file with TurboTax? Read our guide to other alternatives to tax refund advances. TurboTax will then send you your permanent prepaid debit card within 5 to 10 business days. You can use this to shop online the same day you apply. If approved for an advance, you may have access to your advance within an hour of the IRS processing your refund by receiving an email with your temporary card information.

Not filing as a Connecticut, Illinois or North Carolina resident.You also need to meet the following requirements: To qualify for a tax refund advance from Intuit TurboTax, you must file your federal tax return through TurboTax by February 15, 2023. While TurboTax issues its refund on a Credit Karma Visa Debit Card, you can withdraw cash at no cost from its network of 19,000 ATMs. But you don’t have to pay this fee up front - you can have it taken out of your refund after the IRS processes it. The cost depends on whether you do it yourself or choose to file with a tax professional. However, you might need to pay a tax preparation fee to file through TurboTax. Intuit TurboTax doesn’t charge any interest on your refund advance. All international money transfer services.

0 kommentar(er)

0 kommentar(er)